Will a new tariff help build more computer chips in the US?

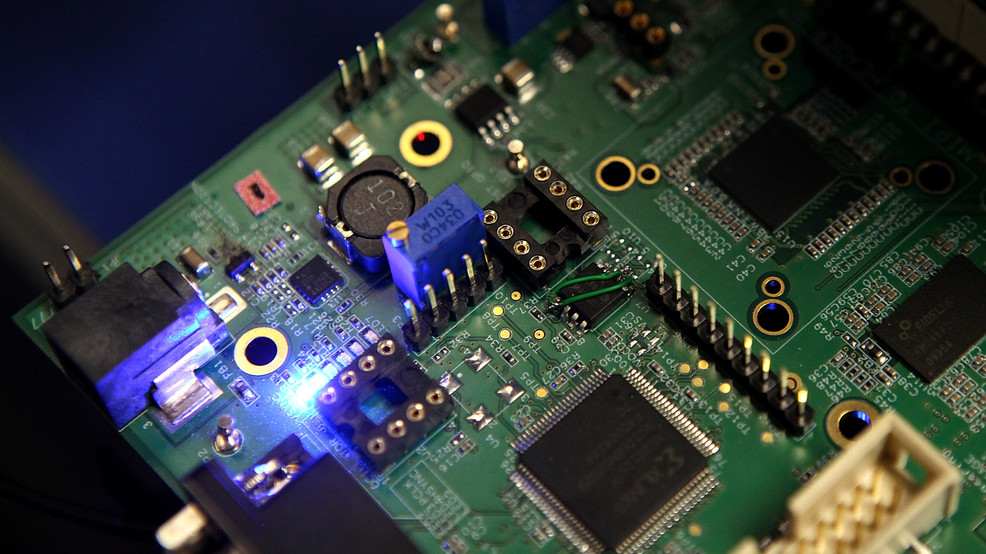

WASHINGTON (TNND) — The White House wrapped up a longstanding investigation into America’s reliance on foreign producers of computer chips and imposed a new set of tariffs that is much narrower than originally threatened and gives the government a cut of sales for semiconductors used for artificial intelligence.

Figuring out how to address the reliance on overseas producers on advanced computer chips has been a challenging dynamic for the Trump administration that has made AI a cornerstone of its economic agenda.

In an order signed on Wednesday, Trump approved a new 25% tariff on what the White House descried as a “very narrow category of semiconductors” that also allow it to take a cut of sales of advanced AI chips sold to China. The tariff will apply to AI chips made abroad that are imported to the United States and then sent out to other countries. It does not apply to chips that are imported to be used in data centers, in products for American consumers, industry uses or the government.

The order still allows Trump to impose broader tariffs later on semiconductor imports and products that contain them unless companies agree to manufacture more chips domestically.

U.S. trade representative Jamieson Greer and Commerce Secretary Howard Lutnick were directed to negotiate agreements with foreign semiconductor producers to “adjust imports” and report on their progress in 90 days. Trump said on Wednesday he could impose “significant tariffs” beyond the 25% depending on how those talks go.

Expanding U.S.-based manufacturing of semiconductors has been a priority dating back to the Biden administration after the pandemic created a major disruption that cast an intense light on the vulnerabilities of the global supply chain of the chips. The Biden administration tried to woo chipmakers with massive subsidies that sailed through Congress with wide bipartisan support in the Chips and Science Act, legislation the Trump White House has criticized. Trump has leveraged tariffs and trade deals to push companies to expand their footprints in the U.S.

“It's too soon to tell if this will have a concrete material impact on domestic capacity,” said Emily Benson, head of strategy at Minerva Technology Futures, a geopolitical and policy intelligence firm. “There's a lot of momentum in and around critical inputs for supply chains that are most important to us ... The question is whether or not we're willing to go out and take that next level of enforceable action that would force companies to reallocate resources here, and a lot of those questions will be answered in the next 90 days.”

Most chip companies manufacture most of their chips in Taiwan and parts of Asia, a significant risk with China’s assertion the island nation belongs to it and could be forced into Beijing’s control. The new tariff comes as the U.S. is reportedly nearing a trade deal with Taiwan that would reduce tariffs on its exports and commit Taiwan Semiconductor Manufacturing Corporation to make significantly more investment in the U.S. The company has already agreed to a $100 billion to build more manufacturing plants.

Trump had threatened to place a 100% tariff on foreign semiconductors unless companies committed to investing into building out production capacity in America. Several major chip producers and other tech companies have announced massive projects worth some $1 trillion since Trump returned to office wielding tariffs to avoid paying hefty tax bills.

Wednesday’s action included a broad exemption to the 25% tariff that includes chips to “support the buildout” of the U.S. supply chain and “strengthening of domestic manufacturing capacity.” It’s unclear exactly what criteria exempts companies from facing the tariff.

“What does that mean? How much do you have to spend? What kind of facility? Do shovels need to be on the ground? Could this be an investment in the services program, for example? A lot of that was unanswered in yesterday's executive action,” Benson said.

A more expansive approach to tariffs on semiconductors comes with risk of higher prices on a wide range of goods, as semiconductors are found in essentially every product that contains an on-and-off switch. The administration is also trying to strike a delicate balance with chip policy and its goal of advancing the country’s artificial intelligence industry and beating China in a race to create the dominant product.

Access to advanced computer chips to power AI models have been a sticking point between Washington and Beijing in delicate trade talks. China is the dominant supplier of lower-grade chips used in consumer goods and weapons and also controls most of the supply chain for critical minerals that are required to build semiconductors.

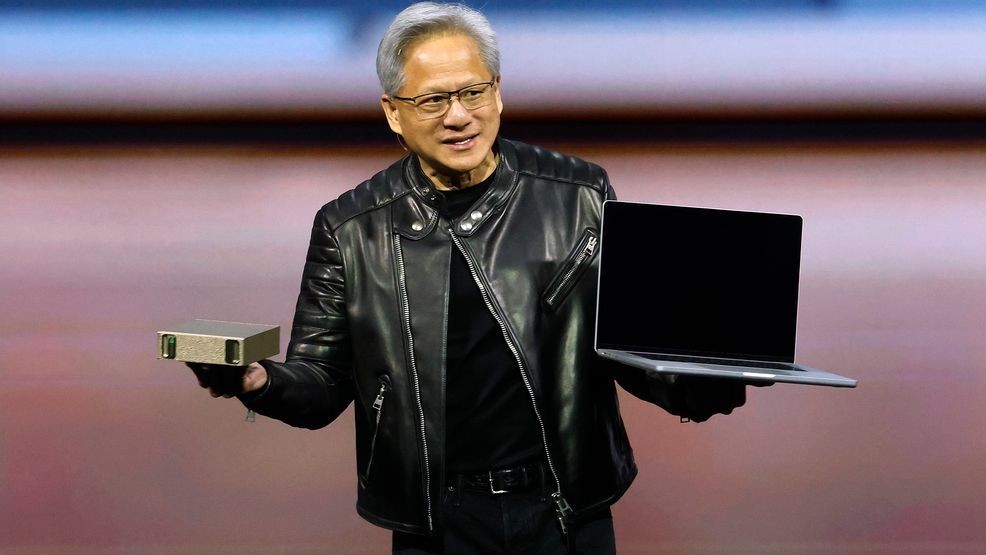

Major manufacturers have had restrictions in place on what can be sold to China over concerns they could be used to build out Beijing’s military capabilities or AI industry using U.S. tech. A rule published on Tuesday allows Nvidia to sell its H200 chip to Chinese buyers after going through safety reviews when the U.S. has an adequate supply and gives the government a 25% cut.